- $3 billion in transactions since 1997

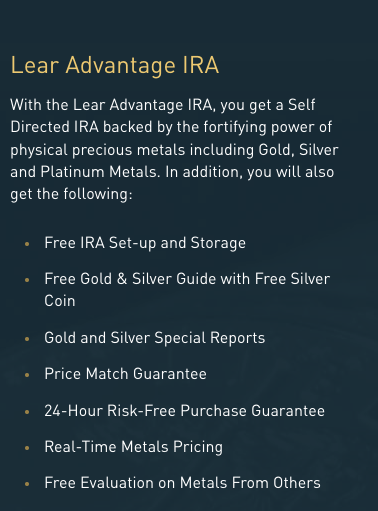

- 24-hour risk-free purchase guarantee

- Free IRA set-up and storage

- Free evaluation on metals from others

- Up to $15,000 in bonus metals with a funded account

We earn a commission if you make a purchase, at no additional cost to you.

Are you looking for an investment strategy that can help protect your wealth from inflation and a recession?

Lear Capital is is one of the best precious metal IRA investments available. With over 20 years in business they provide investors with low risk strategies to ensure their money is safe during times of economic uncertainty. One of the best ways is to consider precious metal iras or setting up some type of ira precious metals account.

Precious metal IRAs offer several advantages such as protecting against currency devaluation, tax benefits and long-term growth potential – all while staying protected from market volatility.

I’ve looked at quite a few options for precious metal IRAs or gold IRA companies and when you’re considering what to do – Lear is one of the best. I recommend taking a look at them and also considering Augusta Precious Metals as an alternative if you’re looking into a precious metals ira or a gold ira. If you have an existing IRA , you can always move your existing IRA into precious metals iras and that’s what Lear is going to help you do whether you want to put gold bullion or silver bullion into it.

Read on to learn more about how Lear helps its customers safeguard their wealth and why it’s considered one of the best choices for retirement savings.

Who Is Lear Capital?

Lear Capital is a leading provider of gold IRA investments and other precious metal investments. Founded in 1997, the company has become one of the most trusted names in the industry for providing investors with protection during times of economic recession and turmoil. Their products are backed by trustworthiness reviews from real customers, ensuring that their clients’ wealth remains safe and secure even when markets fluctuate.

Why gold IRA investments are a smart choice for wealth protection?

Gold IRA investments offer several advantages compared to traditional retirement accounts such as 401(k)s or IRAs: firstly, they provide greater flexibility since you have more control over how much money goes into them; secondly, they’re less susceptible to market volatility than stocks or bonds; thirdly, there’s no income tax on profits earned through these types of accounts; fourthly, there’s no risk associated with owning physical gold because it doesn’t lose its value like paper currency does; finally, if needed you can easily convert your account into cash at any time without penalty fees or taxes.

The benefits of working with Lear Capital

Working with Lear provides access to experienced professionals who understand the complexities of investing in precious metals. They offer competitive prices on their products, as well as free shipping and insurance coverage for orders placed within US borders (including Alaska and Hawaii). Their customer service team is available via phone or email should any questions arise about specific transactions or policies related to investing in precious metals through them. This allows customers to maximize returns while minimizing risks associated with such investments.

Key Takeaway: Lear Capital is a trusted provider of gold IRA investments and other precious metal investments, offering customers the opportunity to protect their wealth during times of economic recession or turmoil. Gold retains its value over time regardless of market conditions, making it an ideal choice for those looking to safeguard their assets. Lear Capital provides competitive prices on products as well as free shipping and insurance coverage within US borders, allowing customers to maximize returns while minimizing risks associated with such investments.

What do their customers think?

Lear is one of the highest rated and reviewed by customers across all the platforms that look at that. Check the links below for the latest but as of December 2022 they are looking really good when seeing what Lear is ranked and reviewed for.

Consumer Affairs: 1,133 Reviews with a 4.7 out of 5 Stars (As of December 6, 2022)

Business Consumer Alliance: 44,600 reviews and a AAA rating – check it out here

Trustpilot: 1,044 Reviews and a 4.9 out of 5 Stars – Check here

How Does Lear Capital Protect Investors During a Recession?

In times of economic uncertainty, many investors turn to gold as a safe haven asset. Gold has historically been used as a hedge against inflation and market volatility, making it an attractive option for those looking to protect their wealth during a recession. Lear Capital is one of the leading providers of gold IRA investments in the United States.

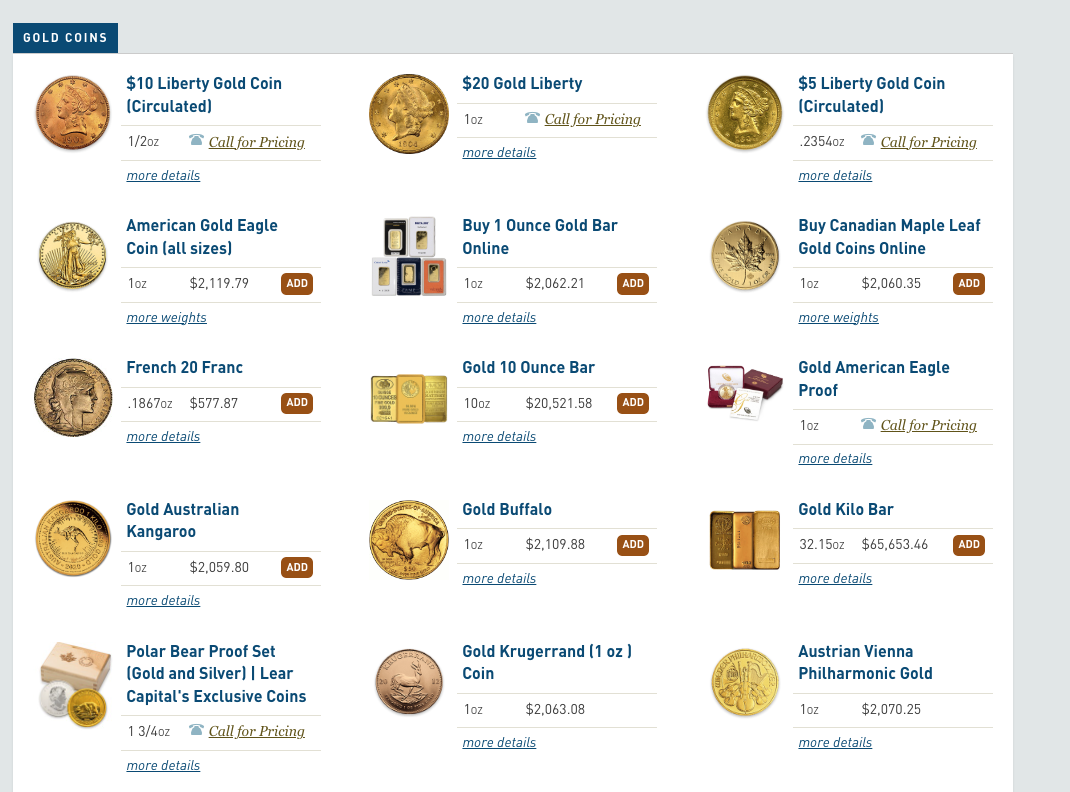

Lear Capital offers investors access to physical gold and other precious metals coins and bars from around the world. Investors can purchase these products directly from Lear or through its online store 24/7 with secure payment options like PayPal or credit card. The company also provides flexible storage solutions including insured vaults located in Switzerland, Canada, and the United States for those who prefer not to keep their assets at home.

The team at Lear Capital understands that investing in gold can be intimidating for some people so they offer personalized advice on how best to diversify your portfolio with precious metals investments such as gold IRAs. They provide comprehensive guidance on which types of coins are most suitable for each investor’s individual needs based on factors such as age, income level, risk tolerance and investment goals.

For those who already have an existing retirement account but want to add more protection against market downturns, Lear Capital also offers transfer services where you can move funds from traditional 401(k)s or IRAs into a self-directed IRA backed by physical bullion without incurring any tax penalties or fees associated with early withdrawals. This allows investors to take advantage of higher returns while still protecting their nest egg should markets crash again in the future.

Overall, working with Lear provides investors with peace of mind knowing that their wealth is protected even during turbulent economic times when stock prices may be volatile due to political instability or global events beyond our control. With its extensive selection of quality products, flexible storage options, personalized advice and transfer services, Lear makes it easy for anyone looking for ways to safeguard their financial future during uncertain times.

Lear Capital offers a range of investments and strategies to help investors protect their wealth during a recession, such as gold and precious metals. In the next heading, we will discuss how Lear Capital helps investors generate wealth over time.

Key Takeaway: You’ll find a safe and secure way to protect their wealth during times of economic uncertainty with Lear. They offer access to physical gold and other precious metals coins, flexible storage solutions, personalized advice on diversifying portfolios, and transfer services for existing retirement accounts. With Lear Capital’s comprehensive range of services, investors can rest assured that their investments are protected even in turbulent markets.

Why Gold IRA Investments Are a Smart Choice for Wealth Protection

Gold IRA investments are a smart choice for wealth protection because they offer stability in times of economic turmoil. Gold is a timeless asset that has always held its value, making it a safe investment during uncertain times. With gold IRA investments, you can diversify your portfolio and protect your hard-earned savings from market volatility.

When the stock market takes a downturn or inflation rises, gold remains relatively stable and continues to appreciate over time. This makes it an ideal way to preserve wealth when other assets may be losing their value due to economic conditions. Additionally, gold offers tax advantages that make it attractive for investors looking to minimize their tax burden while still protecting their financial future.

Investing in gold through Lear Capital allows you access to experienced professionals who understand the nuances of investing in precious metals and how best to use them as part of an overall strategy for building long-term wealth. The company’s team of experts will help guide you through the process so that you can make informed decisions about your investments with confidence. They also provide educational resources such as webinars and articles on topics like retirement planning, estate planning, taxes, insurance and more so that you have all the information necessary before making any decisions regarding your finances or investments.

At Lear Capital, customers benefit from competitive pricing on both physical bullion products like coins and bars as well as ETFs (exchange traded funds) backed by physical metal holdings stored at secure vaults around the world – giving investors peace of mind knowing their assets are safe even if markets crash or currencies devalue rapidly overnight. Furthermore, Lear Capital provides storage solutions for those who prefer not keep their metals at home but instead store them securely offsite where they cannot be damaged or stolen easily by thieves or natural disasters like floods or fires which could destroy entire collections quickly without proper precautions taken beforehand .

Investing in gold IRA’s is a smart choice for wealth protection because it provides stability and growth during periods of economic uncertainty.

In conclusion, Gold IRA investments offer stability during turbulent economic times, tax advantages, and access to knowledgeable professionals who can assist with creating an effective plan tailored specifically towards individual needs. Investing with Lear Capital ensures reliable service backed by years of experience within this field; providing customers with peace of mind knowing they have chosen one of the most trusted names in precious metals investing today.

Key Takeaway: Gold IRA investments offer stability, tax advantages and access to experienced professionals. Lear Capital provides competitive pricing on physical bullion products and secure storage solutions for those who prefer not to keep their metals at home. Investing with them ensures reliable service backed by years of experience in the precious metals industry.

The Benefits of Working With Lear Capital

Working with Lear Capital offers investors a number of benefits. The company has a team of experienced professionals who are committed to helping clients grow and protect their wealth.

One of the primary advantages of working with Lear Capital is protection from inflation. Inflation can erode away at an investor’s portfolio, but Lear Capital provides strategies to help protect against this threat. For example, gold IRA investments can be used as part of an overall strategy for hedging against inflationary pressures. Gold tends to retain its value better than other asset classes in times of economic uncertainty, making it an attractive option for those looking to safeguard their wealth during periods of market volatility or recessionary conditions.

Diversification is another key benefit that comes with working with Lear Capital. By investing in different asset classes such as stocks, bonds, mutual funds and precious metals like gold and silver, investors can spread out risk across multiple markets while still maintaining exposure to potential growth opportunities within each sector. This helps reduce the impact that any single investment may have on your overall portfolio performance over time.

Finally, stability is another advantage offered by Lear Capital when it comes to protecting one’s wealth during difficult economic times such as recessions or bear markets. By diversifying into multiple asset classes and using strategies such as gold IRA investments which tend to hold up better than traditional assets during downturns in the economy, investors can maintain some level of stability even when stock prices fall sharply or interest rates rise unexpectedly due to external factors beyond their control .

Overall, working with Lear Capital provides investors not only access to quality advice from experienced professionals but also the tools they need to manage risks associated with volatile markets while still having exposure to potential growth opportunities within each sector.

Overall, Lear Capital provides a wealth of options to help investors protect their assets from inflation and recession. The next heading will focus on the advantages of gold investments with Lear Capital.

Key Takeaway: Working with Lear Capital provides investors with access to experienced professionals who can help them protect and grow their wealth through diversification, inflation protection strategies such as gold IRA investments, and stability during economic downturns.

Types of Precious Metals Available

Lear Capital offers a wide variety of precious metals for investors to choose from. Gold and silver coins and bars are the most popular options, as they offer an easy way to diversify your portfolio with tangible assets. Gold coins come in various sizes, ranging from 1/10th of an ounce up to one full ounce. Silver coins range from 1/20th of an ounce up to one full ounce. Bars are also available in both gold and silver, ranging from 1 gram all the way up to 400 ounces for gold and 1000 ounces for silver.

Platinum and palladium coins and bars are also offered. Platinum is more rare than gold or silver, making it a valuable addition to any investor’s portfolio. Coins range in size from 1/10th of an ounce up to one full ounce while bars can be purchased starting at 10 grams all the way up to 100 ounces per bar. Palladium is even rarer than platinum but still has its place in investment portfolios due its stability over time compared with other precious metals like gold or silver which can fluctuate significantly depending on market conditions. Coins range in size from 1/10th of an ounce all the way up to 5 troy ounces while bars start at 10 grams going all the way up 500 troy ounces per bar .

They offer investors the opportunity to invest in rare coins and collectibles, which may not have been considered before investing in precious metals such as bullion products. These types of investments often carry higher premiums but can provide unique opportunities, like owning a piece of history or collecting ancient Roman coinage or Civil War memorabilia items that could potentially increase in value over time if properly maintained.

Lear offers a wide range of precious metals investments to help protect your wealth from inflation and recession. Next, we’ll discuss the advantages of investing with Lear.

Key Takeaway: You’ll find a wide variety of precious metals for investors to choose from, including gold and silver coins and bars, as well as platinum and palladium coins and bars. They also offer rare coins and collectibles which may have higher premiums but could potentially increase in value over time if properly maintained.

How to Buy Precious Metals

Buying precious metals is a great way to protect your wealth from inflation and recession. Here’s how you can purchase precious metals with Lear Capital:

Step by Step Guide to Purchasing Precious Metals with Lear Capital: The first step in purchasing precious metals with Lear Capital is to open an account. This process requires basic information such as name, address, phone number, and email address. Once the account has been created, customers can browse the selection of available coins and bars offered by Lear Capital. Customers can also contact their customer service team for assistance in selecting the right product for their needs. After selecting a product, customers will need to enter payment information before confirming their order.

Payment Options for Purchasing Precious Metals with Lear Capital: Customers have several payment options when buying precious metals through Lear Capital including credit/debit cards, bank wire transfers or check payments via mail or online banking services like PayPal or Venmo. Credit/debit card payments are processed instantly while other methods may take up to 3-5 business days before being credited into your account balance at which point you can proceed with placing your order on the website after verifying that funds have been received successfully into your account balance.

Once an order has been placed and paid for using one of the accepted payment methods, it will be shipped out within 1-2 business days depending on availability. All orders are securely shipped via USPS Priority Mail or FedEx Express Shipping Services which provide tracking numbers so customers can monitor progress until delivery is complete. The destination address provided during checkout process upon placement of order on Lear Capital’s website platform hosted by secure servers will ensure safe arrival.

Purchasing precious metals with Lear Capital is a great way to protect your wealth from inflation and recession. Next, we’ll discuss the advantages of investing in gold and other precious metals through Lear Capital.

Key Takeaway: Lear Capital is a great way to protect your wealth from inflation and recession. Customers can open an account, browse the selection of coins and bars offered, and make payments via credit or debit cards, bank wire transfers or check payments. Orders are shipped securely with tracking numbers for peace of mind.

Advantages of Investing in Precious Metals

Investing in precious metals through Lear Capital can be a great way to protect your wealth from inflation and recession. Precious metals, such as gold and silver, are tangible assets that have been used for centuries as stores of value. Investing in these types of investments can provide many advantages over other forms of investing.

1

Tax Benefits

One advantage of investing in precious metals with Lear Capital is the potential tax benefits associated with it. Gold and silver coins purchased through Lear Capital are eligible for long-term capital gains treatment when sold after one year or more, meaning you may pay less taxes on any profits earned from selling them than if you had invested in stocks or bonds. Additionally, gold IRA accounts offer additional tax benefits since they are treated as retirement accounts by the IRS.

2

Diversification Benefits

Another benefit of investing in precious metals with Lear Capital is diversification benefits that come along with it. By adding physical gold and silver to your portfolio, you’re able to spread out risk across different asset classes which can help reduce overall volatility while still providing an opportunity for growth over time. This type of diversification also allows investors to hedge against market downturns since the price movements between different asset classes tend not to move together at all times like traditional stocks and bonds do during a bear market cycle.

In conclusion, investing in precious metals through Lear Capital offers many advantages. These include potential tax savings and increased diversification opportunities within your portfolio, which could lead to better returns over time while protecting your wealth from inflationary pressures caused by economic recessions or periods of high inflation rates.

Investing in precious metals through Lear Capital offers many advantages, such as tax benefits and diversification opportunities. In the next section, we will explore how these investments can help protect your wealth from inflation and a recession.

The Main Point: Investing in precious metals through Lear Capital can provide many advantages, such as potential tax savings and increased diversification opportunities. This type of investment can help protect your wealth from inflationary pressures while still providing an opportunity for growth over time.

FAQs

Is Lear Capital a good investment?

They are a precious metals and gold investment company that has been in business since 1997. They offer a variety of services, including IRA rollovers, physical gold investments, and storage options. Their fees are competitive with other companies in the industry, and they have an A+ rating from the Better Business Bureau. While there is no guarantee of success when investing with any company, they appear to be a reliable option for those looking to invest in precious metals or gold.

Is Lear going out of business?

No, they are not going out of business. The company has been in operation since 1997 and continues to provide a variety of services related to precious metals investments. They are also members of the Professional Numismatists Guild (PNG) and have an A+ rating with the Better Business Bureau (BBB). In addition, they offer secure storage solutions for their customers’ assets as well as educational resources on investing in gold and other precious metals.

Who owns Lear?

Lear is a private company owned by Lear Financial Corporation, a California-based investment firm. The company was founded in 1997 and has since become one of the leading precious metals dealers in the United States. It offers investors gold, silver, platinum and palladium coins as well as bars from various mints around the world. Lear Capital also provides storage solutions for its customers’ investments through its secure vaulting facility located in Salt Lake City, Utah. Additionally, it offers financial advice to help clients make informed decisions about their investments.

Conclusion

In conclusion, Lear Capital is a great way to learn more about the company and its gold IRA investments. With their low-risk strategies for protecting wealth during a recession, investors can rest assured that their money is safe with Lear. Their experienced team of professionals makes it easy to understand the process and take advantage of all the benefits associated with investing in precious metals and gold IRAs. Whether you’re looking for an investment strategy to protect your wealth from inflation or just want peace of mind knowing your retirement savings are secure, Lear Capital has something for everyone.

If you’re interested in seeing where billionaires are putting their cash or finding other gold IRA companies – come check out what else I’ve written about to help you make that decision.

Your gold IRA provder

Lear Capital has processed over $3 Billion in transactions. Check out their gold IRA options.